How big is the housing bubble?

Halifax released it’s latest monthly survey on house prices today which showed prices across the UK falling by 0.3% in February, taking the annual rate of inflation down to 4.2%. This now means the average home in the UK costs £196,649 (or at least it does according to the Halifax, other surveys have different findings). What it clearly shows is that the housing market has slowed over the past couple of months but they believe that house prices can remain flat if the economy and employment levels continue to grow. Now that is a big “if” and not one I would personally like to have my house staked on.

The statistics show that economic growth is holding up at 0.6% in Q3 & Q4 last year but the problem with statistics like these are that they are backward looking. Indeed the technical definition of a recession is flawed as it requires consecutive quarters of economic decline before the criteria are met so you only know once you are in a recession, which is not very helpful.

Whilst there is no easy way of predicting the future you only have to take one look at the stock market to see that investor confidence is weak at the moment with fears of a possible recession just around the corner. Of course all those investors could be wrong, and they have indeed been wrong about things in the past. But it’s not just investors that are worried, Governments have been desperately trying to avert a global slowdown too and have been cutting interest rates to boost consumer confidence (some more than others).

Ok, so it looks like the economic outlook is not great but what about employment levels? On the face of it there is reason to be optimistic as the number of people in employment has risen by 296,000 in the last year, although unemployment has only fallen by 86,000 over the same period (Source:ONS). Which sounds great but the total number of hours worked has actually fallen by 2.3 million over the last quarter to 935.6 million which either suggests that as a nation we are getting lazy or more likely this is a result of more flexible working options reducing the number of hours people on average work, and thus increasing the total number of jobs to compensate. The number of people claiming incapacity benefit also continues to rise and the so called economic inactive population has remained flat making it difficult, if not impossible to draw any conclusions on the true state of the employment market.

So with little statistical evidence or confidence in the economy and employments levels there is a very real threat that both could suffer downturns in the near future. So back to Halifax’s view on house prices, if the economy no longer continues to grow then house prices could start to fall, and if this happens then the question is how far will they fall? I believe the answer to this question can be found by identifying the point where the housing market bubble began (it’s worth noting that it’s just my opinion that we have experienced a bubble and there is no conclusive proof).

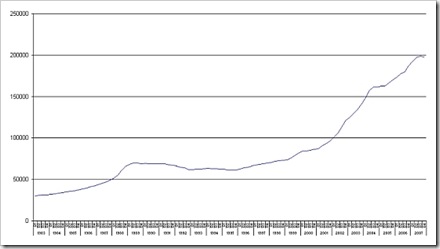

Looking at the statistical evidence of house prices according to the Halifax house price index it is clear that house prices rose during the mid 80s before remaining fairly stagnant during the early 90s. During the late 90s prices grew at a steady rate before really taking off from early 2001. Therefore it looks like the average house price was £87,000 pre-bubble at the start of 2001. In the next 7 years house prices rocketed to a high point of £198,664 before dropping off slightly in the last quarter. This could potentially mean the bubble has inflated prices by over £111,000 although it is more likely that there is an element of real growth buried within this figure.

UK House prices in £GBP (Halifax house price survey)

If we were to assume house prices had continued to grow at the rate they were during the late 90s then you could argue that the average house price should be closer to £125,000, but this would still suggest house prices are almost £75,000 over-valued.

In reality nobody can accurately predict what house prices will do over the coming years, and indeed a counter argument could be made to this article that what we have actually experienced is a prolonged slump in the housing market and that we are now back on the steady growth path that was established in the mid 80s.

1 Comment Leave your comment »

RSS feed for comments on this post. TrackBack URL

Leave a comment